Part 1 Collateral Support

Liqee Lending currently support ETH, BNB, DOT, ATOM, FIL, XTZ, USX backed by dForce and rTokens backed by StaFi. In addition to the assets above, we are assessing a number of other liquid staking solutions and their LP tokens.

This month, we have announced the extension of collateral support to wstETH (wrapped stETH) launched by Lido Finance on Liqee Lending, starting from 20 October. We choose it because it boasts a number of benefits:

- Efficient liquidity – the stETH/ETH pool on Curve is one of the most liquid pools with a total liquidity of $4.8 billion, allowing users to trade stETH for ETH and exit staking at any time.

- Secured – open-sourcing and fully audited by Quantstamp and Sigma Prime. Click here to view full reports.

- Non-custodial – maintain full control over your assets.

- Insurance Providing – work with Unslashed Finance to provide insurance against potential slashing risk.

More details can be checked here.

All Liqee does is aim to offer more flexibilities for Liqee users to choose their favorite assets from the available set of options, and explore new ways to maximize their staked funds. We are willing to hear our users’ voices, so, if you have great ideas or suggestions, please tell us via our Forum.

Proposals Summary:

Proposal to Add Lido’s stETH support

Proposal to Extend Collateral Support to stETH (wstETH) and Its Related LP Tokens

Proposal to List Lido’s wstETH Assets as Liqee’s Collateral

Part 2 Liquidity Mining

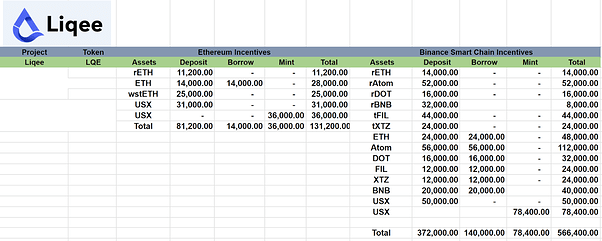

Liqee has launched 【StaFi & dForce & Liqee’s Joint Liquidity Mining】 activities on both Ethereum and Binance Smart Chain. The participants can obtain $LQE, $FIS, and $DF incentives based on personal contributions they give to Liqee. These joint activities lasted for three rounds with a 14-day cycle and finally ended on October 8, 2021. All relevant incentives have been issued. But Liqee still decided to unilaterally maintain the incentives in order to repay our users’ understanding and support.

The details of each round of mining incentives (October) are as follows:

Liqee Liquidity Mining (Oct 1 - Oct 8)

Liqee Liquidity Mining (Oct 8 - Oct 15)

Liqee Liquidity Mining (Oct 15 - Oct 31)

In addition, Liqee has started a new activity 【【Liqee+wstETH】Genesis Liquidity Mining】on October 20,2021. A total of 100,000 LQE (25,000 LQE per week for 4 consecutive weeks) will be distributed as rewards to users who supply stETH to Liqee Lending (the gauge will be reviewed regularly and adjusted as necessary to offer attractive incentive and produce better results). Please visit our Forum for more information.

Part 3 New Activity

Our collaboration with dForce has achieved great success. Given the credit limit has been fully utilized, it handicaps the ability for Liqee users to use USX as liquidity conduit to borrow other assets from dForce for leveraging their liquid staking tokens. In which case dForce decided to increase the aggregate USX inter-protocol limits to 25m USX with flexible split between Ethereum and BSC and also to set the interest rate at 1.5% APR.

View the Official Announcement here.

Part 4 Next Month Plan

- User Interview - Arbitrage Experience

- New Collateral Support - Stablecoins (Like USDT and USDC)

- New Liquidity Mining Activities

Stay tuned for more updates!

Part 5 Community Q&A

Q1: Any airdrop or Giveaway?

A1:Not at the moment, if there’s one we’ll announce in our community like Forum、Twitter or Telegram.

Q2: When will lqe tokens be free?

A2: There’s no timeline yet, the news regarding this will be announced once TGE happens.

Q3: Someone knows where to swap rdots in bsc?

A3: Click here for more details: Native to ERC20 rDOT - Stafi_Protocol

Q4: How to swap rDOTs in a liquidity pool?

A4: We have checked with Stafi, unfortunately it’s not available at the moment. However, they are working on making it available on Pancakeswap pretty soon.

Q5: What are the risks of borrowing ETH (or other borrows that are at 0% apy) against my DOT?

A5: Supplying incentives changes with time as they are not fixed. (Borrow APRs changing)

Q6: Why is there so big of a difference between on the USDC-USDX swap?

A6:Because the pools of the two values are different. This well written article explaining everything: How USX Empower Perpetual Trading | by Mindao YANG | dForce | Oct, 2021 | Medium

Q7: What is the relationship between Liqee’s Admin and Deployer?

A7: Liqee now is still in an early stage, so the deployer plays the role of the admin. But after the LQEs (Liqee’s Governance Token) are distributed, we will choose a suitable time to transform the governance methods into decentralized ones.

Q8: What is the function of Withdraw Reserves?

A8: The function of Withdraw Reserves is that the admin can withdraw profits like interests or minting fees, but don’t worry, users’ funds are safe and won’t be touched.

Q9: Changing the owner to a timelock with a short time limit (such as a 24 or 48 hours) would be sufficient. Is there any chance that this can be done soon?

A9: We have added it to our development plan, which is expected to be completed before the end of November.

Q10: Do Liqee has any liquidity application scenarios now?

A10: Actually, we’ve developed several new scenarios like 【Circular Leveraged Staking】 or 【Assets Bridge】 to increase the attractiveness of our users to move their assets, tutorials can be checked here: Tutorials - Liqee (we will continue updating new related tutorials).

Notice:

We encourage users to join our Telegram to communicate with us directly. But for more important or professional questions (like Technology Related), we suggest users contacting us via [email protected], we will invite experts in related fields to answer.

Part 6 Contributor Recruitment

Liqee aims to become the world’s largest Lending Protocol for Liquid Staking Assets, providing full-chain services and lowering the threshold for users as much as possible. This ambition is by no means an easy task, that’s why we need you to join us!

As long as you recognize our philosophy or have strong interests & unique insights in DeFi & Staking Assets, you are welcomed to be one of us (no matter who you are and no matter where you are). Rest assured, we won’t skimp on rewarding our contributors!

Contact us via [email protected].

Part 7 Recommended Readings

Inspiration Sharing…! Methods to Gain More Profits!

How to Earn 2x Staking Yields on ETH

How to participate in liquidation?

How to repay your loan?

How to supply assets to earn saving interest?

How to borrow underlying tokens?

How to mint stablecoin (over-collateralized loan)?