I am a heavy user of StaFi and am a LP for Curve’s rETH pool. Recently the rETH peg has gotten really bad, and Liqee could be used to really help out. So I spent lots of time on knowing about Liqee! I read an article How to Earn 2x Staking Yields on ETH here, which has surprised me and given me other inspirations on how to use rETHs to earn more profits.

Due to StaFi, Liqee and dForce have successfully achieved their cooperation, I decided to start my idea sharings with these three platforms!

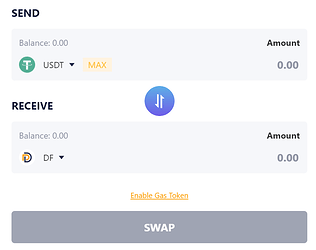

Transaction processes:

-

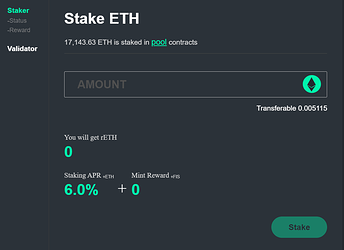

Stake ETH directly on StaFi and gain immediate access to staking yield which is 6% APY.

-

Next come to Liqee Lending and supply rETH as collateral to mint USX.

-

Go to dForce Lending, USX can be used as a bridge connecting to dForce.

———————————————————————————————————

Earn Extra Profits on dForce:

-

Current Deposit

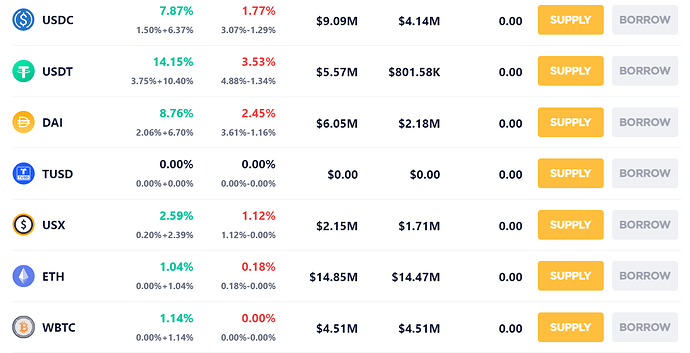

Supply USX to dForce to earn current deposit rewards at 2.59% APY.

-

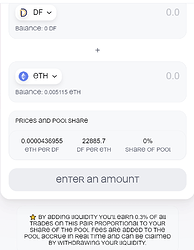

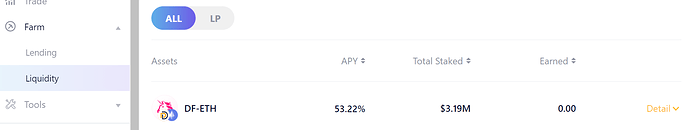

Liquidity Farm

Supply USX as collateral and borrow DF out.

Take DFs to Uniswap and be their DF-ETH Pool’s LP.

The LP Tokens can be used for Liquidity Farming on dForce which is 53.22% APY. (Howwwwwww amazing it is!!!).

-

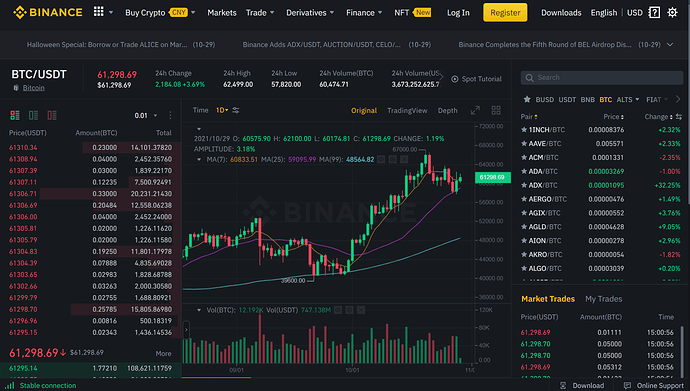

Short-swing Trade

Supply USX as collateral and borrow other assets out. dForce now supports USDC, USDT, DSI, ETH, WBTC, DF and EUX.

Borrowed assets can be swapped into any Tokens you want (both dForce Trade or Uniswap can achieve this).

Swapped Tokens can be used for short-term transactions on various Exchanges (both DEX & CEX). I am accustomed to using Binance.

————————————————————————-——————————

Okkkkkk, that’s all!

Now I am projecting to test the feasibility of my assumptions. Hope more inspirations can be shared!!! (By the way, Liqee is definitely a great platform which can truly solve the liquidity problems of staked assets, and it should be known by more users!!