This tutorial is translated & modified from @Rebecca’s Article 《如何用ETH赚取双倍Staking收益》, click here to view the original text.

*Please note: Liqee encourages our users to share their own experiences & opinions with us. But All arbitrage methods mentioned in our tutorials are only used for reference, and can not be regarded as investment advice.

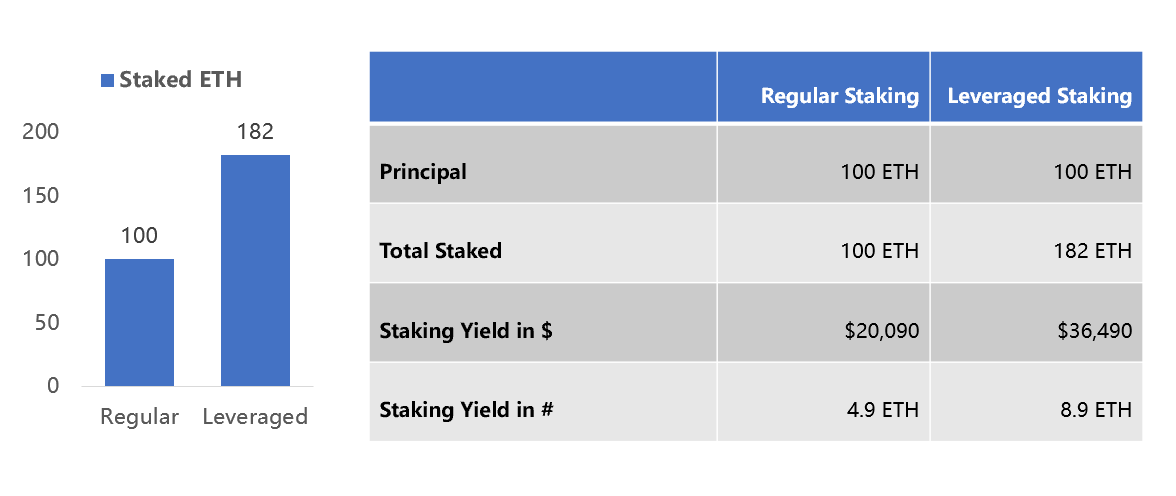

Staking offers stable return with comparatively low risk. But not many people know we can leverage DeFi lending to achieve 2x staking yield on our staked funds!

It is glad to see Liqee announced their collateral support to wstETH, meaning that we can use wstETH as collateral to borrow ETH, and mint more wstETH for leveraged staking yields!

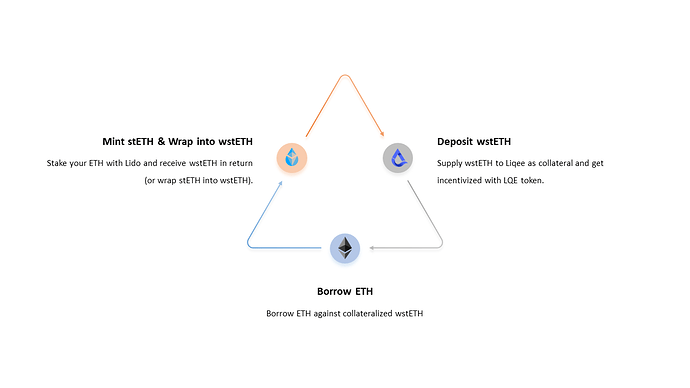

How Does it Work?

- Wrap ETH into wstETH directly through Lido and gain immediate access to staking yield which is 4.9% APY at the time of writing.

- Go to Liqee Lending and supply wstETH as collateral.

- Borrow ETH from Liqee Lending.

- Mint more wstETH from Lido.

- Repeat previous steps to earn up to 2x staking yield.

What’s the Catch?

Gentle Reminder:

- wstETH’s LTV is 70%, meaning that you can borrow up to 70 ETH against 100 wstETH (it is recommended to borrow below ‘Safe Max’ to reduce the possibility of liquidation)

- Supply wstETH to borrow ETH is immune to price swings as both assets track the price of ETH.

- Borrowing interest will be paid in the same type of assets (i.e., borrow ETH, interest also needs to be paid in ETH), so it will produce a slow growth of outstanding loans. So, participants must:

- Always keep the Adequacy Ratio above 1 to avoid loan delinquency which may trigger liquidation of your collateralized wstETH with 10% discount.

- Please also take into consideration of the borrowing interest when you calculate the total combine yield from leveraged staking.

Related Guides

How to get stETH?

How to get wstETH?

How to supply wstETH to Liqee?

Liqee Liquidity Mining

Starting from 20 October, a total of 100,000 LQE (25,000 LQE per week for 4 consecutive weeks) will be distributed as rewards to users who supply stETH to Liqee Lending. Visit Liqee’s Forum for the latest gauge arrangement.

About Liqee

Liqee is the world’s largest decentralized lending protocol for liquid staking assets, with all lending and borrowing activities facilitated through smart contracts in a decentralized manner. Liqee Lending currently support ETH, BNB, DOT, ATOM, FIL, XTZ, wstETH backed by Lido, and rTokens backed by StaFi.

As an eco-partner of dForce, Liqee utilizes the smart contracts of dForce Lending which is audited by 4 top audit firms including Trail of Bits, ConsenSys Diligence, CertiK and Certora (click here to view full reports), and integrates with USX stablecoin natively which can be used as collateral to borrow all assets currently supported by Liqee and dForce.

Liqee’s core team include experts with a long-track record of success in PoS validation service and DeFi lending. Liqee also provide tokenization for PoS and mining facilities, as well as PoS validation across a number of networks.

Visit Liqee’s website to check out more.