We are thrilled to announce the extension of collateral support to wstETH (wrapped stETH) launched by Lido Finance on Liqee Lending, starting from 20 October.

Our community expressed strong interest in onboarding more liquid staking assets, with stETH taking the lead. stETH is the tokenized version of staked ETH launched by Lido Finance, dominating the booming staking market for Ethereum 2.0 with a market cap of $5.3 billion, accounting for 87.4% market share of Ethereum 2.0 liquid staking derivative tokens, according to Dune Analytics.

With the impending transition to towards ETH 2.0 and Lido’s strong presence in the emerging staking economy, there are strong reasons to believe the integration of stETH will help Liqee capture new ETH liquid staking derivative inflows at a greater scale.

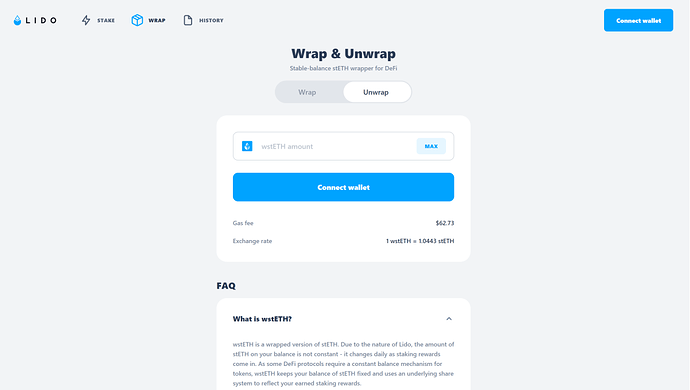

Given stETH is a rebase token with balance changing daily to reflect earned staking rewards, making it difficult to integrate with our lending protocol, instead of directly supporting stETH, Liqee will integrate with wstETH (wrapped version of stETH). Users can use Lido Protocol to wrap/unwrap wstETH at any time. The exchange rate changes every day to keep track of accrued staking rewards for users.

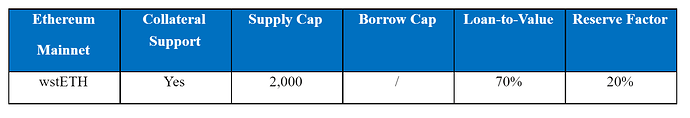

Here are the initial parameters for wstETH (wrapped stETH) which can be further adjusted through LiqeeDAO governance.

In addition to stETH, we are assessing a number of other liquid staking solutions and their LP tokens, offering more flexibilities for Liqee users to choose their favorite assets from the available set of options, and explore new ways to maximize their staked funds.

Stay tuned for more updates!

Liqee Liquidity Mining

Starting from 20 October, a total of 100,000 LQE (25,000 LQE per week for 4 consecutive weeks) will be distributed as rewards to users who supply stETH to Liqee Lending. Please note the gauge will be reviewed regularly and adjusted as necessary to offer attractive incentive and produce better results. Please visit our Forum for the latest gauge.

What are wstETH and Lido?

wstETH is a wrapped version of stETH launched by Lido, representing the staked ETH in Lido, including the initial deposit value as well as daily staking rewards.

Lido Finance is an Ethereum 2.0 Staking Protocol, providing liquidity for staking assets by issuing tokenized derivatives. Lido allows users to obtain returns from staking while using the same assets to earn additional incomes from DeFi.

For more information about Lido, stETH and wstETH, please visit their website.

Benefits of wstETH (wrapped stETH)?

When staking with Lido, users receive stETH (staked ETH) in return. Each stETH represents the value of your initial ETH deposit plus staking rewards increasing daily in balance. You can use the Lido Protocol to wrap stETH/ETH to wstETH (and vice versa) at any time to participate in Liqee Lending.

stETH boasts a number of benefits, including:

- efficient liquidity – the stETH/ETH pool on Curve is one of the most liquid pools with a total liquidity of $4.8 billion, allowing users to trade stETH for ETH and exit staking at any time.

- secured – open-sourcing and fully audited by Quantstamp and Sigma Prime. Click here to view full reports.

- non-custodial – maintain full control over your assets.

- work with Unslashed Finance to provide insurance against potential slashing risk.

How to Get wstETH?

- You can use Lido Protocol to wrap wstETH at any time (and vice versa).

- Connect your wallet.

- Enter the amount of stETH or ETH you would like to wrap from, and you will be able to see unlock fee, gas fee, exchange rate, and the amount of wstETH you should expect to receive.

- Click on ‘Wrap’ to continue.

- Confirm the transaction from your wallet.

- Now, you should be able to check the balance of wstETH in your wallet (the exchange rate between wstETH and stETH changes every day to reflect the earned staking rewards).

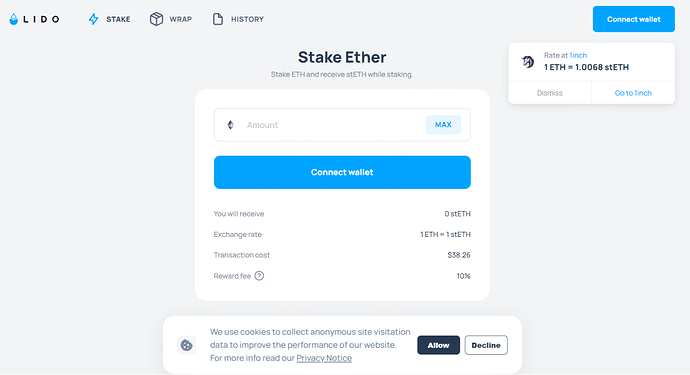

How to Get stETH?

- You can use Lido Protocol to stake ETH and receive stETH in return.

- Connect your wallet.

- Enter the amount of ETH you would like to stake with Lido, and click on ‘Submit’ to continue.

- Confirm the transaction from your wallet.

- Now, you will be able to check the balance of stETH in your wallet (1:1 with ETH).

About Liqee

Liqee is the first liquid staking token lending market powered by dForce’s lending protocol, it also provides tokenization for PoS and mining facilities and provides PoS staking services across a number of networks. We strive for becoming the largest lending protocol for liquid staking tokens and unified portal for liquid staking markets.

For more information on Liqee, please check out our website here .