We’ve introduced the PCS Perpetual Mechanism and its two market conditions before.

Articles can be checked here: Introduction: PCS Perpetual Mechanism.

It’s clear and easy to understand the condition of PCS Perpetual Mechanism in Natural Balance of Lending Liquidity; But how about the situation of PCS Perpetual Mechanism in Unnatural Balance of Lending Liquidity? How do PCS Protocols control related accounts to intervene in regulation?

Here we will explain the detailed processes.

-

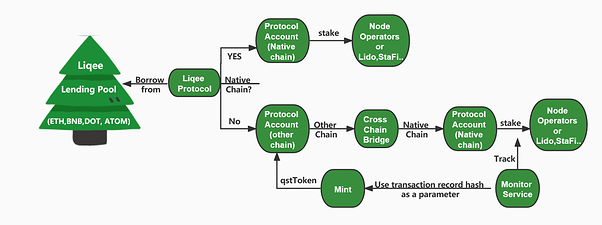

Liqee protocol will monitor lending behaviors: if the borrowing amount is always far less than the deposit amount, PCS protocols will automatically borrow native assets from Liqee lending pool to its PCS-related accounts;

-

Liqee currently supports the assets on the Ethereum Main Network and Binance Smart Chain;

-

Only source chain assets can be staked, so, before borrowing the native asset to related accounts, PCS protocols will first check whether the native asset is a source chain asset. For example:

- BNB on Binance Smart Chain could be identified as a source chain asset;

- ATOM on Binance Smart Chain could not be identified as a source chain asset, in other words, it is an unsource chain asset (ATOM’s source chain is Cosmos);

-

(Part-Yes)

If the native asset is identified as a source chain asset, PCS protocols will directly borrow it from Liqee Lending Pool to the Source Chain Account, and then deliver it to node operators (select randomly from whitelist) or staking platforms (eg. Lido) to earn staking income. For instance:

- Borrow ETH from Liqee Lending Pool to the Ethereum-Main-Network Account, then deliver the borrowed ETH to node operators or staking platforms to stake;

- Borrow BNB from Liqee Lending Pool to the Binance-Smart-Chain Account, then deliver the borrowed BNB to node operators or staking platforms to stake.

-

(Part-No)

If the native asset is identified as an unsource chain asset, PCS Protocols will first borrow it from Liqee Lending Pool to the Asset-Located Account, then transfer it back to its corresponding source chain through Asset Cross-Chain Bridge, the transferred asset will be stored in a specific corresponding Source Chain Account, after then be delivered to node operators (select randomly from whitelist) or staking platforms (eg. Lido) to earn staking income. Here belows the sample:

- ATOM on Binance Smart Chain is identified as an unsource chain asset (ATOM’s source chain is Cosmos);

- PCS protocols will first borrow ATOM from Liqee Lending Pool to the Binance-Smart-Chain Account;

- Asset Cross-Chain Bridge will be used as a tool to transfered ATOM from Binance Smart Chain to Cosmos;

- the transferred ATOM(on Cosmos now) will be stored in the Cosmos Account, then be delivered to node operators or staking platforms to stake.

-

In order to better enable the Liqee Dao community to monitor Liqee’s behavior (for safety), Liqee has developed a monitoring tool ‘Monitor Service’. PCS’s staking behavior will be detected automatically once Monitor Service is set to be started: when it detects that the staking operation has been finished successfully, it will use the Transaction Record Hash as a parameter to mint qstTokens to the Asset-Located Account. With this type of transaction certificate, transaction status will be checked much more easily.

-

Regardless of whether the borrowed asset is a source chain asset or not, Liqee PCS Protocol’s revenue will gain from the spread between saving and borrowing interest, as well as the spread between staking yield and borrowing interest.

Liqee PCS Related Readings

Introducing Protocol Controlled Staking

What is Liqee PCS?

Why Lending? Why Liqee PCS?

Introduction: PCS Perpetual Mechanism