What is PCS Perpetual Mechanism?

Perpetual Mechanism is an ingenious invention that was setup by Liqee to keep borrowing and lending in a balanced liquidity, in which case the user’s supply APY will always present a positive feedback.

How does PCS Perpetual Mechanism work?

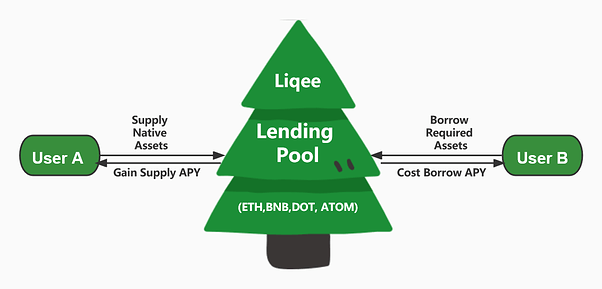

Situation1 - Natural Balance of Lending Liquidity

The natural balance of lending liquidity means that, the liquidity of lending is balanced only by users’ own behavior (deposit or borrow), without the influence of external forces.

- User A(Supplier) deposits the native assets that supported by Liqee(like ETH or BNB) into the Liqee Lending Pool, gets the deposit certificate qToken (such as qETH, qBNB) and earns Supply APY Revenues;

- User B(Borrower) provides the collateral supported by Liqee and lends the desired assets (like ETH or BNB) out. When the prices of both (the collateral and the loaned assets) are rise, user B can gain huge profits from the market, while the only cost is Borrowing Interest;

- Supply APY is directly proportional to the amount of borrowing assets, which forms a positive feedback loop towards users’ income;

- User A(Supplier) has highly flexible payment processing rights: there is no lock-up time limit for their deposited assets.

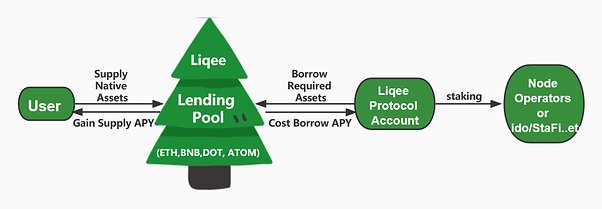

Situation2 - Unnatural Balance of Lending Liquidity

The natural balance of lending liquidity generally occurs when market conditions are good, we don’t need to worry about this ideal situation. But how about the opposite? What will happen if the market conditions are messy? Actually, PCS is the most efficient tool prepared for the terrible market ——

Liqee will use PCS Protocols to automatically borrow the native assets from Lending Pool , then deliver them to the node operator for stake to earn staking revenues. In fact, most of the proceeds earned by PCS protocol will be used to repay the borrowing interests, and the remaining parts will be used to fill the Liqee Treasury: not only aim to ensure the assets-adequacy of Lending Pool, but also aim to protect the users’ rights: Highly flexible deposits and withdrawals.

- Users(Supplier) who deposit the native assets that supported by Liqee(like ETH or BNB) into the Liqee Lending Pool, can get the deposit certificate qToken (such as qETH, qBNB) and earn Supply APY Revenues;

- Liqee protocol will monitor lending behaviors: if the borrowing amount is always far less than the deposit amount, Liqee protocol will automatically borrow assets to its PCS-related accounts, after then deliver these assets to node operators(select randomly from whitelist) or staking platforms (eg. Lido) to earn staking income;

- Supply APY is directly proportional to the amount of borrowing assets & income of staking behavior; in addition, the balance of borrowing&lending liquidity can be fully guaranteed due to the intervention of PCS protocols, which forms a positive feedback loop towards users’ income.

- Liqee PCS protocol’s revenue is from the spread between saving and borrowing interest, as well as the spread between staking yield and borrowing interest.

- Users (Suppliers) have highly flexible payment processing rights: there is no lock-up time limit for their deposited assets.